Best Practices in Analyzing Potential Real Estate Investment Properties

For people who are new to real estate, analyzing a potential investment property can be a daunting task. Whether you are a homebuyer looking to buy your first home or a real estate investor looking to make an investment, understanding the key aspects of analyzing a real estate investment property is crucial to making informed decisions. Let’s discuss the best practices to consider when analyzing a potential real estate investment property to help you make better decisions!

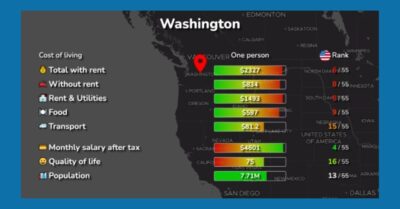

Know the market and location

The first step in analyzing a real estate investment property is to know the market and the location. You can do this by researching the location of the property and finding information about the local demographics, lifestyle, amenities and job market. By knowing this information you’ll get an idea of the location’s potential for future growth, appreciation or depreciation. A few online resources for researching the location of a property include Zillow, Redfin, and Realtor.com.

Analyze the property’s potential income

As a real estate investor, it is essential to understand the potential income of a property before making an investment. You can do this by checking the prices of surrounding rental properties and estimating how much rent the property can yield based on its features. Also, find out if there are any other rental properties in the area that have vacancies. This can help to gauge how popular the area is for renters. Some useful online tools for estimating rental value include Rentometer and Zillow rentals.

Calculate the potential return on investment (ROI)

Calculating the potential return on investment (ROI) is crucial in real estate investment analysis. ROI is the amount of profit generated based on the investment made. To determine the potential ROI of a property, calculate the expected income from the property and subtract the expenses such as property taxes, insurance, maintenance, utilities, and mortgage payments. A good ROI in real estate investment is 10% or higher. Your SJA Real Estate Advisor will be happy to help calculate your potential investment property ROI.

Take into account any repairs and renovations

It is also essential to consider the repairs and renovations that may be needed to increase the value of the property. This can also affect the property’s overall ROI. Take a look at the condition of the property, and make a list of repairs and renovations that may be required. This will help to determine the cost of bringing the property up to the appropriate standards. It is always a good idea to hire a professional inspector to evaluate the property before purchase.

Assess the potential risks of the investment

Lastly, assess the potential risks of the investment property by analyzing the market conditions, the historical performance of the location, and any other potential risks such as property taxes, natural disasters, and any zoning changes that could impact the property. Identifying the potential risks will help you manage them as you make a decision on whether to invest in the property or not.

In summary, analyzing a potential real estate investment property requires knowledge of the location, estimated property income, potential ROI, repairs and renovations, and risks associated with the investment. By following these best practices, you can make informed decisions regarding real estate investments. Remember that it’s crucial to conduct thorough research, consult with professionals, and evaluate potential returns before making a final decision. With this information, you’ll be better equipped to make sound decisions that lead to potential long-term success in the world of real estate investing.